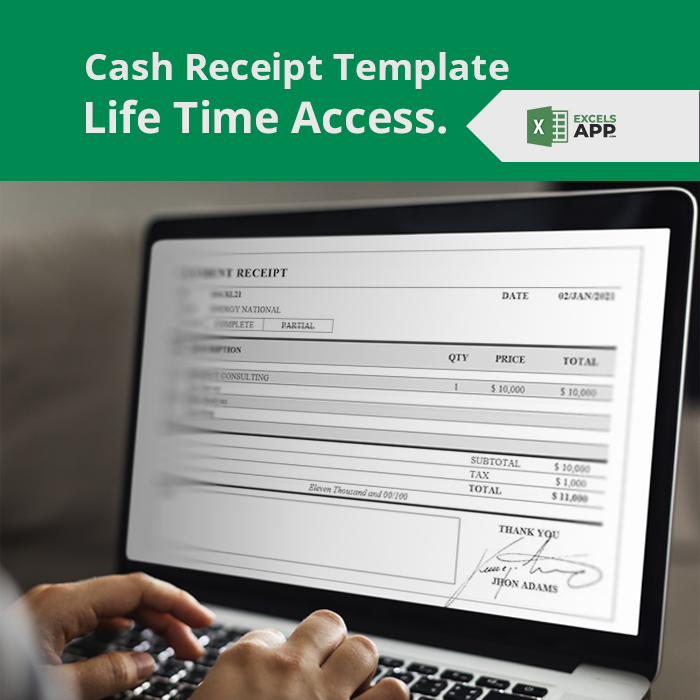

Cash Receipt Template

£10.00

Effortlessly record cash transactions with our Cash Receipt Template for Excel. This user-friendly template simplifies the process of creating professional cash receipts. Key features include a customizable header, sections for payer details and payment information, automatic calculation of totals, and a space for payer acknowledgment. It’s a must-have tool for businesses and individuals seeking a convenient way to document cash payments. Download and use this template to ensure your financial records are organized and accurate.

Get a FREE Google Sheets Spreadsheet here

A cash receipt is a crucial document that serves as proof of a financial transaction when cash is involved. Whether you’re running a business, organizing an event, or just need to acknowledge cash payments, a well-structured cash receipt is essential. This Cash Receipt Template for Excel provides a professional and easy-to-use solution for creating comprehensive cash receipts.

Key Features:

- Header Section:

- Business Name/Logo: Insert your business name and logo for branding.

- Receipt Number: Assign a unique receipt number for tracking purposes.

- Date: Record the date of the transaction.

- Cashier/Receiving Agent: Document the name of the person handling the payment.

- Payer Information:

- Name: Enter the name of the individual or entity making the payment.

- Address: Record the payer’s address for contact information.

- Contact Information: Include a phone number or email address for further communication.

- Payment Details:

- Payment Method: Specify the method used for the payment (cash, check, credit card, etc.).

- Payment Amount: Clearly state the amount received.

- Description: Provide a brief description of the purpose of the payment, such as “product purchase” or “event admission.”

- Items/Services Sold:

- Item/Service: List the products or services for which the payment is made.

- Unit Price: Specify the price of each item or service.

- Quantity: Record the quantity of each item or service.

- Total Amount: Automatically calculate the total cost for each item or service.

- Additional Notes:

- Include a section for any additional notes or terms and conditions related to the payment.

- Totals Section:

- Subtotal: Calculate the subtotal of all items or services.

- Tax: Include any applicable taxes.

- Discount: Deduct any discounts from the subtotal.

- Total: Automatically calculate the final total after tax and discounts.

- Payment Received and Signature:

- Provide a space for the payer to acknowledge the receipt of the payment by signing and dating the document.

How to Use:

- Fill in your business name, logo, and contact information in the header section.

- Assign a unique receipt number and enter the date of the transaction.

- Fill in the payer’s details, payment method, and description of the payment.

- List the items or services sold, along with their unit prices and quantities. The template will calculate the totals.

- Add any extra notes or terms and conditions.

- The template will automatically calculate the subtotal, taxes, discounts, and the final total.

- Have the payer sign and date the receipt to acknowledge the transaction.

This Cash Receipt Template for Excel is designed to help you create professional, organized, and easy-to-understand receipts for any cash transaction. It simplifies the process of documenting payments, making it an essential tool for businesses and individuals alike.

Ifunaya Ochemba –

Incredibly user-friendly, making it a breeze to create professional.

Nia Duncan –

Professional look

Chris Lawson –

Modern appearance

Connor Fraser –

Smooth functionality

Elius Turner –

Well crafted